Progressing...

Secure Your Financial Future & Become Your Own Bank

We will show you how to leverage an infinite banking IUL policy to turn your expenses into tax free retirement income, protect your money from market volatility, protect your income from rising taxes. and how to keep up with inflation.

Watch My Policy Demonstration

In this video I will disclose my personal private reserve policy and teach you how to become your own bank and leverage your every day life expenses and turn them into massive tax free wealth.

Our Mission Is To...

Infinite Life Group is a non captive agency that partners with over 50 different insurance carriers nationwide which an has an exclusive IUL product that allows us to provide our clients with the most growth at the lowest cost.

Our goal to create financial independence for all!

Guaranteed to not be effected by market down turns

Experience uncapped interest crediting. Sky is the limit

Borrow money against the policy while still compounding

Create tax free life time retirement income

Why Our Exclusive IUL Is The Best..

Less than 1,000 agents and advisors have access to this exclusive IUL product in the entire country.

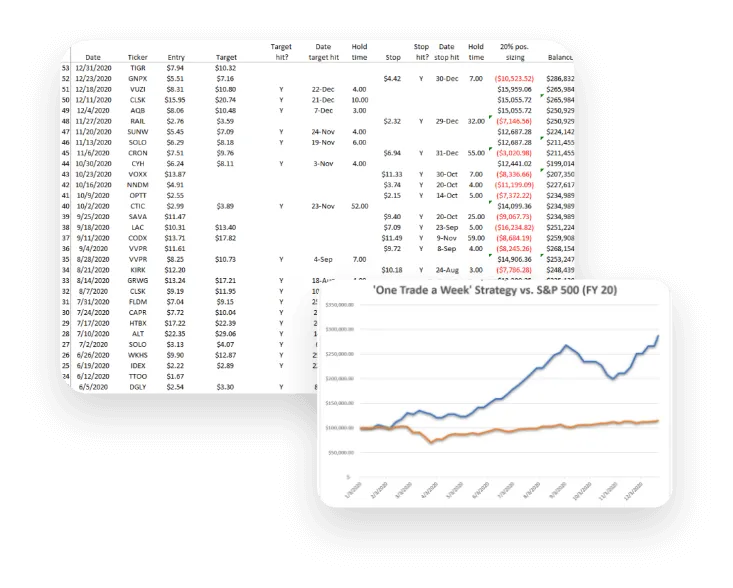

Our proven market strategy provides you with...

Uncapped Interest Crediting: There is no cap on what you can earn

235% Participation Rate: Multiply our interest crediting by 235% of the index return.

Exclusive Combo Riders: We have the ability to use term as the majority of the insurance to lower the cost of insurance and give the ability fund tons of cash into the policies.

How You Earn Interest

Most IUL policies have small participation rates between 85% to 180% Our exclusive IUL currently has a 235% participation rate But what does that even mean? Here is a example

If you cash value this year is $100,000 and the index return this 10% the insurance company will credit your account 10% X 2.35 = 23.50% of your Cash value! Now next year your new balance would be your new contributions + $123,500 and it just keeps growing from there...

Schedule a 30 minute zoom meeting with us so we can build out a complimentary customized plan to meet your needs and crush your goals!

At it's core an IUL policy is a type of permanent life insurance contract that offers both a death benefit and a cash value component. Its unique feature is that the cash value's growth is tied to a market index, like the S&P 500 and Barclays, allowing for potential market-linked gains while also providing protection against market downturns. This means you can not lose your money ;)An IUL could be used as a financial tool as well which allows you to save and grow your money, protect your family, and plan for retirement with huge tax advantages.

Planning for retirement and building your wealth can be confusing with so many options out there, like 401ks and other retirement accounts. But have you heard about IULs? They're something worth considering, especially if you want to protect your money and potentially earn tax-free income.

Let's break down the problems your current strategy may impose:

Market Volatility and Losses: Traditional retirement accounts like 401ks can be risky because they're tied to the stock market. This means your money's value can go up and down, and you might end up losing some of it due to market fluctuations.

Taxes and Fees: With traditional accounts, you'll have to pay taxes when you withdraw your money in retirement. Plus, there are often hidden fees eating into your savings, sometimes without you even realizing it.

Contributions and Penalties: There are limits on how much you can contribute to traditional accounts like 401ks, and if you withdraw money too early, you could face penalties.

No Living Benefits Or Life Insurance: If you become ill or critically injured while working unfortunately you're 401k or other accounts will not offer you tax free money to cover medical. When you die all your family will inherit is the balance of the account and have to pay tax on it.

Here Is What You May Have Forgot To Think About...

What most people forget to think about is with 401k and other retirement accounts when you start using the money from the account as retirement income you are now decreasing its value and earning less interest on less money every year. In addition to decreasing the account you are paying taxes and the money is still exposed to the market.

What happens when you're over 70 and you've been depleting your retirement fund and we have a market crash... This could be devastating! and usually what makes people go back to work in their golden years. You need to protect yourself and plan for the future accordingly.

Why Our IUL May Be The Better Choice?

An IUL, or Indexed Universal Life insurance, offers a different approach to retirement savings and wealth building:

Uncapped Earnings: Unlike traditional IUL accounts, The IULs we use do not have a cap on how much you can earn. Your money grows based on the performance of a stock market index, but with a guaranteed minimum interest rate of 0% to 1.25% per year and a 20 year average of over 21% per year.

Guaranteed Tax-Free Income: One of the biggest perks of an IUL is that you can access your money in retirement without paying taxes on it. This can save you a lot of money over time.

Flexibility: You're not limited in how much you can contribute to an IUL, and you can access your money as early as 12 months without facing penalties unlike other retirement accounts.

Includes Living Benefits & Life Insurance: Unlike other accounts if you are to get ill or injured and no longer can work our policies will pay you up to 1 million dollars tax free. Living benefits is a very important part of insurance that every person should have. In addition to living benefits a IUL policy will included a death benefit that never expires and only continues to grow. This allows you to feel comfortable knowing your family is well taking care of if the unexpected happens.

With an IUL, you can borrow money from your cash value without having to pay the money back and with out interrupting the growth of your account. Here's how it works:

Let's say you have $100,000 in your IUL account, and you need $80,000 for an opportunity, investment, pleasure, really what ever you want. It's your money and you can take it for what ever and when ever you want.

You decide to request a loan, and the insurance company gives you $80,000 tax-free. Your original $100,000 stays in your account, continuing to earn interest, you don't have to make scheduled payments on the loan, and there are no credit checks. When you pass away, the insurance company deducts what you owe them from your death benefit when you die, leaving the rest for your beneficiary.

I always get asked… Why is the insurance company willing to give me a loan and why do I not have scheduled monthly payments to pay it back?

This is very easy to answer and understand… The insurance company doesn't need to check credit or require scheduled payments back because when you die the insurance company will pay themselves back what you owe them plus a little interest and pay your beneficiary the balance. It's a win-win for you and the insurance company.

Think about it... The insurance company has to pay your family when you die anyway so it makes sense for them to loan you the money now and charge some interest on it. That means it's less money they have to pay out later.

I get the same response zoom meeting after zoom meeting... This sounds too good to be true! Why am I just learning about this now?The fact is it is too good to be true for many people. Not everyone can qualify for an uncapped IUL but the ones that do are very fortunate, This is by far one of the most powerful accounts you will ever have. The only question is can you get one?

Not all IUL policies are created equal. There are tons of insurance companies out there so how do you know which one to pick. Here is all you need to know.

1.) Makes sure your IUL is uncapped. Many IUL have a cap on them which means there is a limit to how much you can earn. One thing you do not want to do is cap your wins.

2.) Make sure you have a high participation rate. Must companies are between 85% to 180% which is the highest I have seen besides our exclusive product. Participation rate can fluctuate so you want to make sure there is a index strategy available that guarantees at least 100% participation.

3.) Most important they must be structured correctly. when structuring a IUL we need to make sure the cost of insurance is as low as possible and we utilize the lowest death benefit possible so we can maximize your growth.

We already explained to you what is bad so now let me shine some light on our exclusive IUL product. Firstly there are only about 1,000 argents and advisors who can service this contract for you. The reason is our affiliated group together does over 500 million in sales for one of the larges and oldest mutual insurance companies in the US. For this reason the two came together and created an exclusive product with unique riders that make our strategy possible.

1.) Our IUL is uncapped: Sky is the limit on how much interested your account can be credited.

2.) We have combo riders available that allow us to use term and whole life together to help you max fund a policy at lowest cost possible.

3.) Our participation rate is currently 235% vs competitors are around 85% to 180%

4.) We use a mutual company rather then a stock insurance company.

5.) We are experts in the field. I am a Dimond award winning advisor with over 10 plus years of experience in finance.

Underwriting IULs can be a bit tricky but if you work with the right people anything is possible. Typically IULs require a person to be in good health physically and mentally. Ideally the younger you are the lower the cost of insurance will be which means the better the performance, but what if your older or have medical issues can you not take advantage of this strategy?

Inexperience would say yes you can not qualify but here is how we can do it. You are allowed to own a policy no mater how old or sick you are. If you have a child or grandchild we can put the insurance on them and make you the owner so you can control the policy but have a cost basis based on a younger person.

This is a win win. You get a policy and can reap the benefits and after you pass the policy will continue to grow until the insured passes. Now you create wealth for yourself and a massive legacy for your family.

© Copyright 2021. Infinite Life Group. All rights reserved.